The Rise of Physical AI: Automakers and Robotics at CES 2026

The Consumer Electronics Show (CES) 2026 showcased a surge in physical AI innovations, especially in robotics. U.S. automakers are notably absent, with the spotlight on tech companies and Chinese manufacturers. Hyundai's exhibit featured humanoid robots and autonomous technology, highlighting a shift in automotive focus. President Trump's welcoming remarks about Chinese automakers sparked controversy among U.S. industry insiders. Canada is reducing import taxes on Chinese electric vehicles, contrasting with U.S. restrictions.

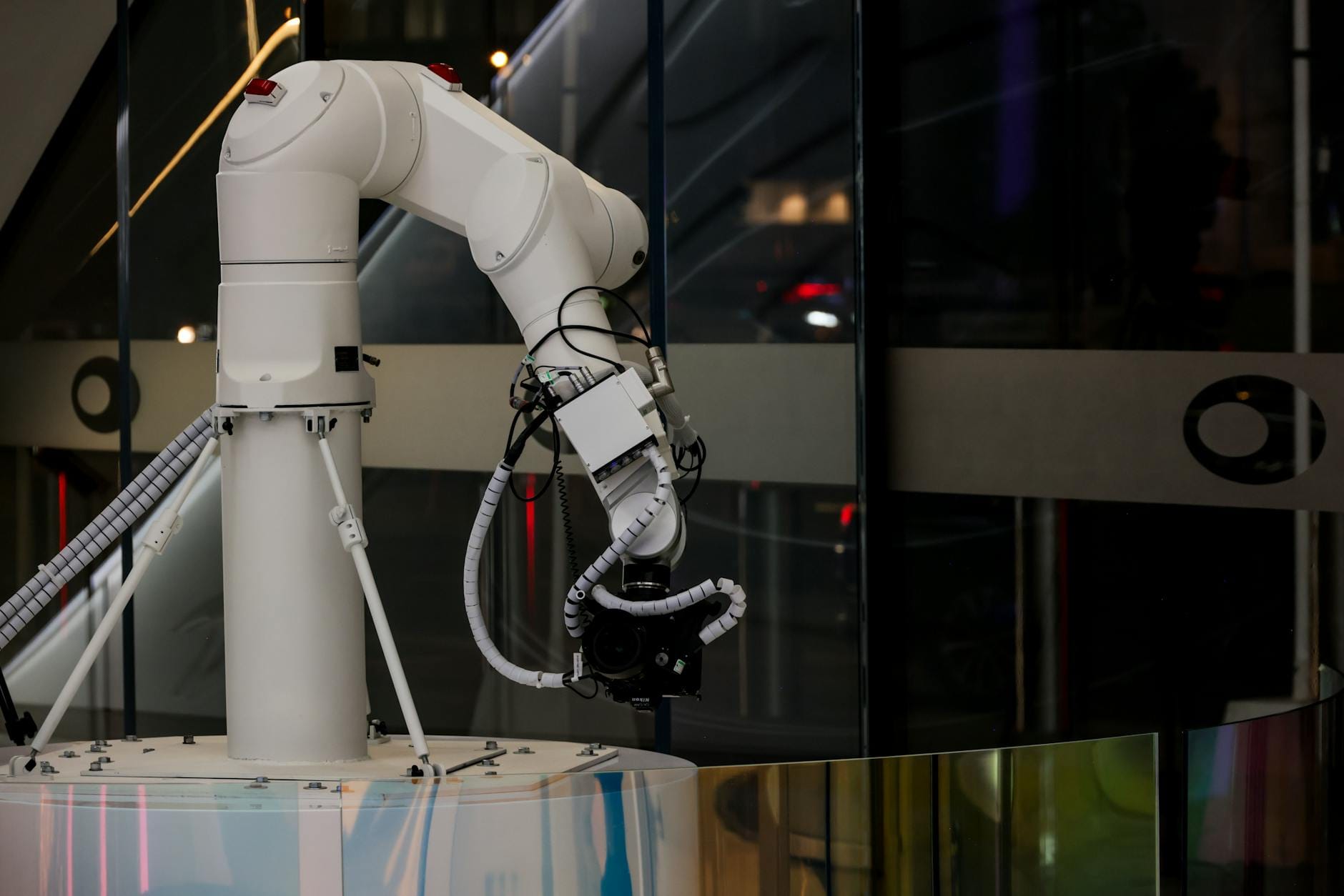

As the New Year unfolds, the Consumer Electronics Show (CES) in Las Vegas has become the epicenter for the latest advancements in technology, particularly in the realm of transportation and robotics. In 2026, the show marked a significant pivot away from traditional U.S. automakers, who have largely vacated the exhibition space. Instead, the spotlight shone brightly on autonomous vehicle tech companies and a plethora of Chinese automakers, alongside a growing fascination with what industry leaders are dubbing "physical AI." This term, also referred to as embodied AI, encapsulates the integration of artificial intelligence into the physical world, allowing machines to interact intelligently with their environments.

The buzz around physical AI was palpable at CES, with companies like Zoox, Waymo, and Hyundai leading the charge. While Hyundai is known for its vehicles, this year it showcased an array of robots, including the Atlas humanoid robot developed by Boston Dynamics, a subsidiary of the Hyundai Motor Group. Attendees were treated to demonstrations of innovative technologies such as a robot designed to charge electric vehicles and a versatile four-wheeled platform called the Mobile Eccentric Droid (MobEd), set to enter production this year. The fervor surrounding humanoid robots and physical AI suggests a shift in focus within the automotive industry, as it embraces robotics to meet new challenges and opportunities.

Amnon Shashua, co-founder and president of Mobileye, recently acquired a humanoid robotics startup for a staggering $900 million. When questioned about the skepticism surrounding humanoid robots, Shashua drew parallels with the early days of the internet, suggesting that while hype might inflate valuations temporarily, it does not negate the underlying reality of the technology. This sentiment reflects a broader belief in the potential of humanoid robots, which could soon play a pivotal role in various sectors from transportation to healthcare.

While the excitement over physical AI was evident, the event was not without its controversies. President Trump's remarks at a Detroit Economic Club meeting stirred discontent within the U.S. automotive sector. His comments about welcoming Chinese automakers to build plants in the U.S. were met with apprehension by industry insiders, particularly those at the Alliance for Automotive Innovation. Concerns were raised about the implications of such a move, especially in light of existing U.S. laws that restrict the import and sale of vehicles from certain countries, including China.

Avery Ash, CEO of the nonpartisan organization SAFE, expressed alarm over the potential risks of allowing Chinese manufacturers to enter the U.S. market. He pointed out that this could jeopardize the hard-won advancements made in the U.S. automotive industry and compromise national security. Ash emphasized that the experience in Europe and elsewhere shows that such strategies can backfire, leading to detrimental effects on both the automotive sector and the broader defense industrial base.

In stark contrast, Canada has taken a different approach, announcing a significant reduction in import taxes on Chinese electric vehicles, from a hefty 100% to just 6.1%. This move, announced by Canadian Prime Minister Mark Carney, could open the floodgates for Chinese electric vehicles in the Canadian market, highlighting a divergence in how neighboring countries are handling foreign automotive competition. This policy shift reflects Canada's strategy to foster a competitive automotive market and embrace the growing influence of electric vehicles.

As CES wrapped up, other significant developments in the mobility sector were also making headlines. Allegiant, a budget airline, revealed plans to acquire Sun Country Airlines for approximately $1.5 billion, signaling a consolidation trend in the aviation industry. Meanwhile, in the realm of technology, companies like Dealerware and JetZero announced strategic acquisitions aimed at enhancing their service offerings and product lines. JetZero, known for its innovative triangular aircraft designed for fuel efficiency, raised $175 million in a recent funding round, underscoring the ongoing investment in sustainable aviation technologies.

On the ground, Joby Aviation, a pioneer in electric air taxis, is ramping up production capabilities with a new manufacturing facility in Dayton, Ohio. This move aligns with the company's goal to double its output to four aircraft per month by 2027, showcasing the growing momentum behind urban aerial mobility solutions. The development of air taxis represents a significant shift in how urban transportation could evolve, potentially alleviating congestion on the roads and providing faster travel options for city dwellers. However, not all news in the sector was positive; Luminar, a lidar technology company, announced a disappointing deal to sell its lidar business for just $22 million, a stark contrast to its peak valuation of $11 billion in 2021. This decline underscores the volatility of the tech sector, particularly for companies heavily invested in emerging technologies.

In the realm of policy, New York Governor Kathy Hochul is expected to introduce legislation that would legalize robotaxis across the state, excluding New York City. This proposal aims to expand the existing autonomous vehicle pilot program, potentially allowing for a limited deployment of commercial robotaxis in areas outside the bustling city. This move could set a precedent for other states considering similar legislation as the demand for autonomous transportation solutions continues to grow. The implications of such legislation are profound, as they may pave the way for a future where autonomous vehicles become a commonplace mode of transportation, reshaping urban landscapes and mobility patterns.

As the landscape of mobility continues to evolve, companies are also adapting their business models to meet changing consumer demands. Tesla announced a shift away from a one-time fee for its Full Self-Driving software, opting instead for a subscription model. This change reflects a broader trend in the industry toward recurring revenue streams, as companies recognize the value of providing ongoing software updates and features to customers. The subscription model not only provides a steady income stream for automakers but also allows consumers to access the latest advancements in technology without the burden of a large upfront cost.

Additionally, on-demand drone delivery service Wing has expanded its partnership with Walmart, bringing its delivery capabilities to an additional 150 stores. This move highlights the increasing integration of drone technology into everyday retail operations, paving the way for more efficient logistics and delivery solutions. As consumer expectations for rapid delivery continue to rise, companies are exploring innovative ways to streamline their operations and meet these demands.

The excitement surrounding CES 2026 underscores a pivotal moment for the automotive and technology industries. As physical AI takes center stage, the interplay between robotics, autonomous vehicles, and public policy will shape the future of transportation. With ongoing debates about foreign competition and national security, the coming years promise to be critical in determining the direction of the automotive sector and its role in the global economy. The developments at CES signal a transformative era where technology, policy, and consumer preferences converge, setting the stage for a new chapter in mobility and innovation. As the industry grapples with these changes, it is clear that the integration of physical AI will not only redefine how we think about transport and mobility but also challenge existing paradigms in manufacturing, labor, and regulatory frameworks. Stakeholders across all sectors must adapt swiftly to this evolving landscape, ensuring they remain competitive in a world increasingly dominated by intelligent machines and automated solutions.